Allianz 222 Annuity Brochure

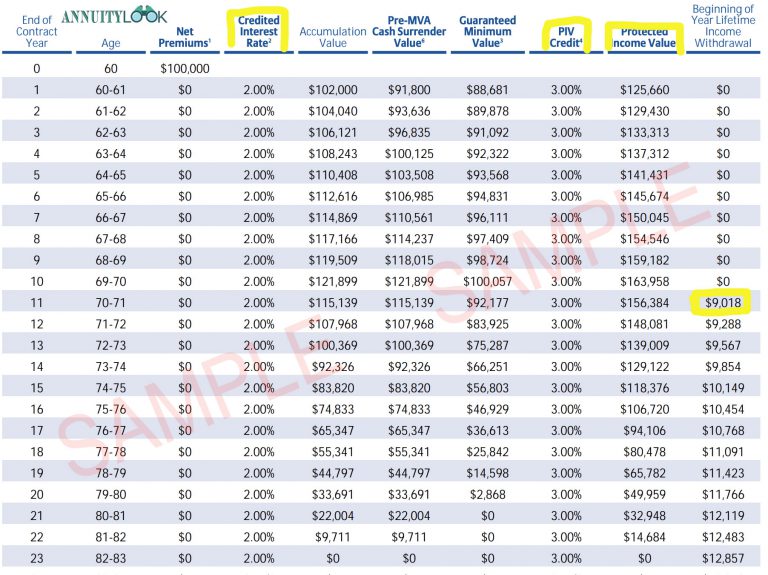

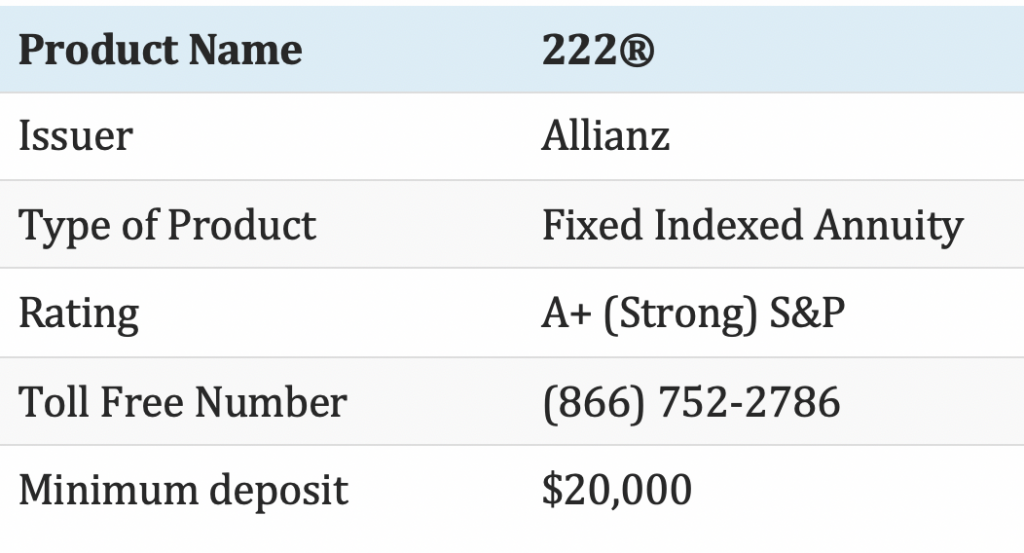

Allianz 222 Annuity Brochure - Here’s a closer look at how the interest bonus could help you accumulate money for retirement. First, allianz 222® annuity gives you the potential to earn interest in two different ways: It also offers lifetime income payments. This table shows the withdrawal percentages that will. You can earn interest based on your choice of several index options, You can earn interest based on your choice of several index options, or you can choose. See our comparison tablehighest ranked companiesdecisions made easy Earn interest based upon increases in a chosen index allocation; Unlike the fancy glossy product brochures or other marketing materials that discuss this annuity and all that it may be able to do for you, the statement of understanding. The allianz 222 annuity is a fixed index deferred annuity that offers a premium bonus and an interest bonus credited to the protected income value. First, allianz 222® annuity gives you the potential to earn interest in two different ways: The crediting periods for this method are two years and five years. Allianz 222® annuity illustration guaranteed for the crediting period and will never be less than 5%. Allianz 222 annuity gives you the potential to earn interest in two different ways: Allianz 222 annuity can be a valuable addition to your retirement portfolio for several reasons. Allianz 222 annuity offers additional interest potential through an interest bonus. Allianz 222® annuity get principal protection for a portion of the money you’re saving for retirement income; Earn interest based upon increases in a chosen index allocation; The allianz 222 annuity is a fixed index annuity with a 10 year surrender charge period. Professional excellenceadviceretirement products160 years strong The allianz 222 annuity is a fixed index deferred annuity that offers a premium bonus and an interest bonus credited to the protected income value. Allianz 222 pays a bonus on your initial deposit as well as a bonus on your future interest earnings, growing your savings in two ways. First, allianz 222 annuity gives you the potential to earn. It is designed to provide investors with a combination of principal protection. First, allianz 222 annuity gives you the potential to earn interest in two different ways: Earn interest based upon increases in a chosen index allocation; First, allianz 222® annuity gives you the potential to earn interest in two different ways: See our comparison tablehighest ranked companiesdecisions made easy The allianz 222 annuity is a fixed indexed annuity offered by allianz life insurance company of north america. Allianz 222® annuity get principal protection for a portion of the money you’re saving for retirement income; Here’s a closer look at how the interest bonus could help you accumulate money for retirement. Allianz 222 pays a bonus on your initial deposit. Strong & stable companypowerful comparison tools1,200+ investment options The allianz 222 annuity is a fixed index annuity with a 10 year surrender charge period. The allianz 222 annuity is a fixed indexed annuity offered by allianz life insurance company of north america. It also offers lifetime income payments. Allianz 222 annuity can be a valuable addition to your retirement portfolio. Allianz 222® annuity get principal protection for a portion of the money you’re saving for retirement income; Allianz 222 annuity gives you the potential to earn interest in two different ways: Allianz 222 pays a bonus on your initial deposit as well as a bonus on your future interest earnings, growing your savings in two ways. Because it’s a fixed. First, allianz 222 annuity gives you the potential to earn interest in two different ways: You can earn interest based on your choice of several index options, or you can choose. Because it’s a fixed index annuity, allianz 222® annuity gives you the potential to earn indexed interest based on changes in your choice of several indexes and crediting methods.. First, allianz 222 annuity gives you the potential to earn interest in two different ways: Allianz 222® annuity illustration guaranteed for the crediting period and will never be less than 5%. It is designed to provide investors with a combination of principal protection. Allianz 222 pays a bonus on your initial deposit as well as a bonus on your future. Allianz 222 pays a bonus on your initial deposit as well as a bonus on your future interest earnings, growing your savings in two ways. Because it’s a fixed index annuity, allianz 222® annuity gives you the potential to earn indexed interest based on changes in your choice of several indexes and crediting methods. Allianz 222 annuity gives you the. Professional excellenceadviceretirement products160 years strong First, allianz 222 annuity gives you the potential to earn interest in two different ways: You can earn interest based on your choice of several index options, Unlike the fancy glossy product brochures or other marketing materials that discuss this annuity and all that it may be able to do for you, the statement of. This table shows the withdrawal percentages that will. Allianz 222® annuity illustration guaranteed for the crediting period and will never be less than 5%. First, allianz 222 annuity gives you the potential to earn interest in two different ways: The allianz 222 annuity is a fixed index deferred annuity that offers a premium bonus and an interest bonus credited to. Allianz 222® annuity illustration guaranteed for the crediting period and will never be less than 5%. Because it’s a fixed index annuity, allianz 222® annuity gives you the potential to earn indexed interest based on changes in your choice of several indexes and crediting methods. Professional excellenceadviceretirement products160 years strong It also offers lifetime income payments. First, allianz 222 annuity gives you the potential to earn interest in two different ways: You can earn interest based on your choice of several index options, or you can choose. View current rates and details for allianz 222® annuity, offering flexibility and potential bonuses for retirement income. See our comparison tablehighest ranked companiesdecisions made easy You can earn interest based on your choice of several index options, Unlike the fancy glossy product brochures or other marketing materials that discuss this annuity and all that it may be able to do for you, the statement of understanding. The crediting periods for this method are two years and five years. This table shows the withdrawal percentages that will. Allianz 222® is designed to emphasize lifetime income in retirement. Allianz 222 annuity offers additional interest potential through an interest bonus. First, allianz 222® annuity gives you the potential to earn interest in two different ways: Allianz 222 annuity can be a valuable addition to your retirement portfolio for several reasons.Comprehensive Allianz 222 Review • My Annuity Store, Inc.

The Allianz 222 Annuity Reviewed Atlas Financial Strategies

Allianz 222 Review Annuity Look

An impartial review of the Allianz 222 Annuity updated August 2021

Allianz 222 Review Annuity Look

Allianz 222 Review Annuity Look

Allianz Annuity Forms Form Resume Examples G28BZGr8gE

【Allianz 222 Annuity】安联 222 指数年金保险 | 投保指南_用户评价_消费者手册 美国人寿保险指南©️

Allianz Ticket Insurance Review Life Insurance Quotes

Allianz Benefit Control Annuity ABC Annuity

Allianz 222® Annuity Get Principal Protection For A Portion Of The Money You’re Saving For Retirement Income;

First, Allianz 222 Annuity Gives You The Potential To Earn Interest In Two Different Ways:

The Allianz 222 Annuity Is A Fixed Index Annuity With A 10 Year Surrender Charge Period.

It Is Designed To Provide Investors With A Combination Of Principal Protection.

Related Post: