Mutual Of Omaha Living Promise Brochure

Mutual Of Omaha Living Promise Brochure - • no more than $20,000 of living promise graded benefit coverage • no more than $25,000 of all graded benefit coverage with united of omaha Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical bills, unexpected expenses or. Compare premiums, issue ages, face amounts and underwriting. Living promise whole life insurance level benefit plan: Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. At mutual of omaha, we offer living promise as your whole life insurance solution. This policy pays benefits directly to your beneficiary, builds cash value, and. A living promise whole life insurance policy from united of omaha life insurance company pays benefits directly to the person you choose. Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. Living promise provides two plans: This policy pays benefits directly to your beneficiary, builds cash value, and. Living promise provides two plans: At mutual of omaha, we offer living promise as your whole life insurance solution. Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical bills, unexpected expenses or. Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical A living promise whole life insurance policy from united of omaha life insurance company pays benefits directly to the person you choose. It can help take care of your final expenses,. Living promise provides two plans: Request a free quoteaffordable optionshighly rated carriersno health questions Compare premiums, issue ages, face amounts and underwriting. • no more than $20,000 of living promise graded benefit coverage • no more than $25,000 of all graded benefit coverage with united of omaha At mutual of omaha, we offer living promise as your whole life insurance solution. Depending on which plan you qualify for, you’ll have varying face amounts and. It can help take care of your final expenses,. A living promise whole life insurance policy from united of omaha life insurance company pays benefits directly to the person you choose. This policy pays benefits directly to your beneficiary, builds cash value, and. Licensed agentssave time & moneyquick mobile form Living promise provides two plans: Having a living promise whole life insurance policy in place may allow you to relax a little more because you know the planning is done. A living promise whole life insurance policy from united of omaha life insurance company pays benefits directly to the person you choose. Living promise whole life insurance level benefit plan: United of omaha life insurance.. Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. At mutual of omaha, we offer living promise as your whole life insurance solution. At mutual of omaha, we offer living promise as your whole life insurance solution. Living promise is designed to help provide affordable protection that pays benefits directly to the person. A living promise whole life insurance policy from united of omaha life insurance company pays benefits directly to the person you choose. A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person you. At mutual of omaha, we offer living promise as your whole life insurance solution.. Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. Living promise whole life insurance. Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical At mutual of omaha, we offer living promise as your whole life insurance solution.. • no more than $20,000 of living promise graded benefit coverage • no more than $25,000 of all graded benefit coverage with united of omaha Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. A living promise whole life insurance policy from united of omaha life insurance company pays benefits directly to the. A living promise whole life insurance policy from united of omaha life insurance company pays benefits directly to the person you choose. At mutual of omaha, we offer living promise as your whole life insurance solution. Learn how to protect your loved ones from the costs of your final expenses with a living promise whole life policy. This policy pays. Living promise provides two plans: Having a living promise whole life insurance policy in place may allow you to relax a little more because you know the planning is done. A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person you. This policy pays benefits directly to. Living promise whole life insurance. Learn how living promise can protect your loved ones from the costs of your final expenses with whole life insurance. Learn about the features and benefits of living promise whole life insurance, a level or graded plan with optional riders. Having a living promise whole life insurance policy in place may allow you to relax. Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. Compare premiums, issue ages, face amounts and underwriting. Compare plans, benefits, and riders, and find out how to apply online or. Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical bills, unexpected expenses or. United of omaha life insurance. Learn about the features and benefits of living promise whole life insurance, a level or graded plan with optional riders. A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person you. Living promise whole life insurance level benefit plan: Learn how to protect your loved ones from the costs of your final expenses with a living promise whole life policy. Depending on which plan you qualify for, you’ll have varying face amounts and premium options available. Having a living promise whole life insurance policy in place may allow you to relax a little more because you know the planning is done. Living promise is designed to help provide affordable protection that pays benefits directly to the person you choose to take care of your outstanding medical bills, unexpected expenses or. It can help take care of your final expenses,. Living promise provides two plans: This policy pays benefits directly to your beneficiary, builds cash value, and. Depending on which plan you qualify for, you’ll have varying face amounts and premium options available.Mutual of Omaha Living Promise Whole Life Burial Insurance Review

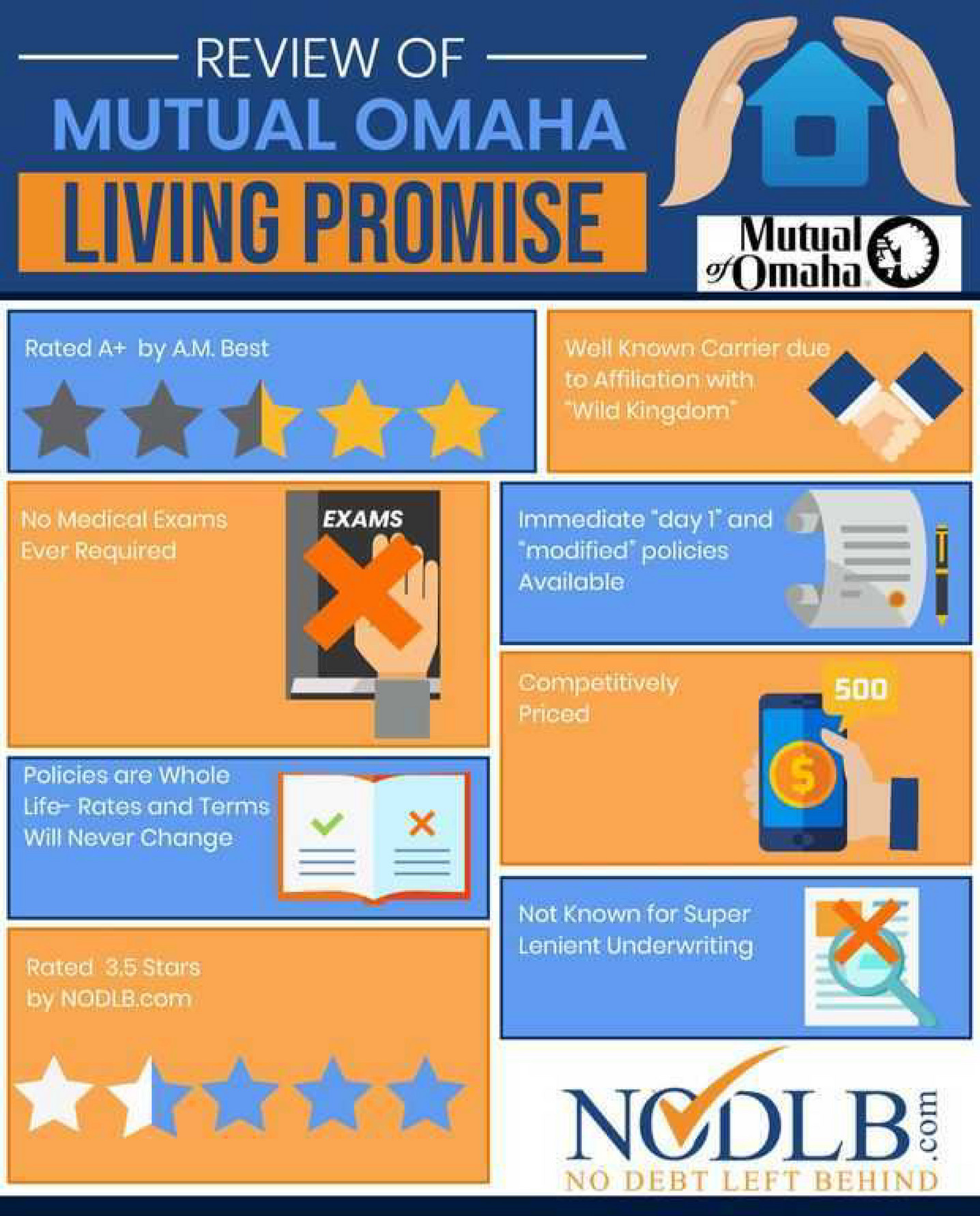

My publications Mutual of Omaha Living Promise Review Page 1

Mutual of Omaha Your Insurance Group Agents

Mutual of Omaha Your Insurance Group Agents

Mutual of Omaha Your Insurance Group Agents

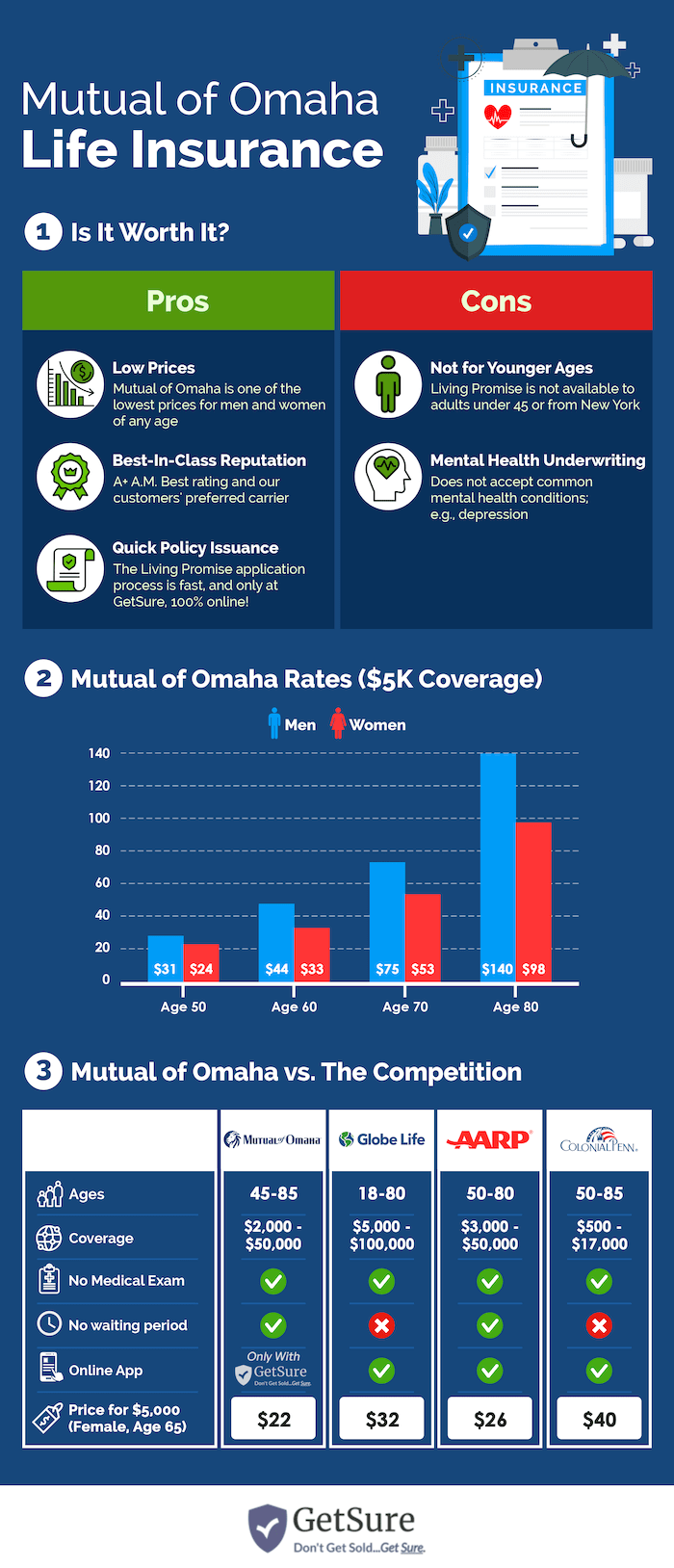

Mutual of Omaha Life Insurance Guide [Best Coverages + Rates]

Mutual Of Omaha Guaranteed Issue Life Insurance Review

Mutual of Omaha Living Promise and IUL Express Oct 2023 YouTube

Mutual of Omaha Living Promise A Comprehensive Guide by

Mutual of Omaha Life Insurance For Seniors

Depending On Which Plan You Qualify For, You’ll Have Varying Face Amounts And Premium Options Available.

Living Promise Provides Two Plans:

Living Promise Provides Two Plans:

• No More Than $20,000 Of Living Promise Graded Benefit Coverage • No More Than $25,000 Of All Graded Benefit Coverage With United Of Omaha

Related Post:

![Mutual of Omaha Life Insurance Guide [Best Coverages + Rates]](https://www.effortlessinsurance.com/wp-content/uploads/2019/11/84631c20-mutual-of-omaha-homepage-medium-e1574105212993-1000x1024.png)