One America Annuity Care Ii Brochure

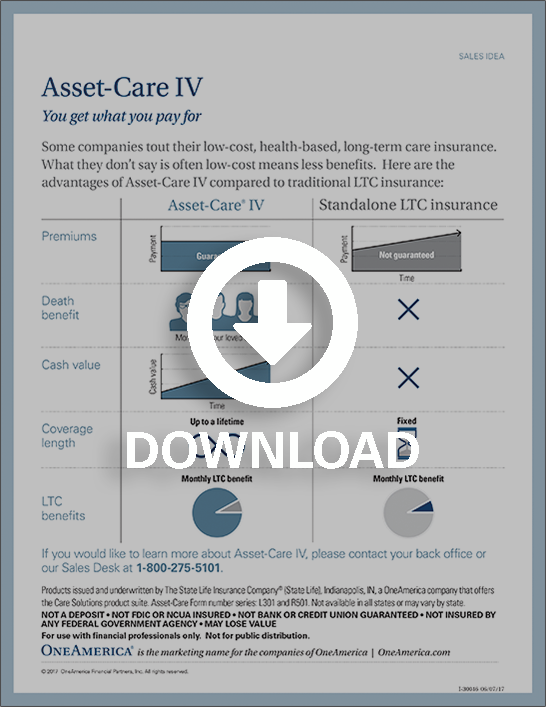

One America Annuity Care Ii Brochure - How does annuity care ii work? Transfer an existing annuity into an annuity care product and access those assets without federal tax penalties. As part of the oneamerica®. Reallocating existing annuities into annuity care ii can help maximize those assets if they're needed to pay for qualifying ltc expenses. See our comparison tabledecisions made easyinformed consumers know Oneamerica/the state life insurance company describes the annuity care ll as a guaranteed interest rate annuity that is combined with the protective elements for end of life care. When clients utilize their annuity care for qualifying ltc. By reallocating existing assets like savings, a certificate of deposit (cd) or an annuity. • a higher interest rate is credited to funds. Strong & stable companypowerful comparison toolssmarter strategies When clients utilize their annuity care for qualifying ltc. Oneamerica/the state life insurance company describes the annuity care ll as a guaranteed interest rate annuity that is combined with the protective elements for end of life care. • a higher interest rate is credited to funds. Have you saved and invested enough to live on during retirement? By reallocating existing assets like savings, a certificate of deposit (cd) or an annuity. See our comparison tabledecisions made easyinformed consumers know Consumervoice.org picksreviewed by 1,000scompare top 10 brandstrusted reviews How does annuity care ii work? 160 years strongprofessional excellencecontinuous learningadvice Have you saved and invested enough to live on during retirement? Strong & stable companypowerful comparison toolssmarter strategies Transfer an existing annuity into an annuity care product and access those assets without federal tax penalties. When clients utilize their annuity care for qualifying ltc. Your four steps to get the care to meet your needs 1. See our comparison tabledecisions made easyinformed consumers know By reallocating existing assets like savings, a certificate of deposit (cd) or an annuity. How does annuity care ii work? As part of the oneamerica®. • a higher interest rate is credited to funds. Transfer an existing annuity into an annuity care product and access those assets without federal tax penalties. With higher issue ages and more relaxed underwriting requirements compared. As part of the oneamerica®. Your four steps to get the care to meet your needs 1. Consumervoice.org picksreviewed by 1,000scompare top 10 brandstrusted reviews Reallocating existing annuities into annuity care ii can help maximize those assets if they're needed to pay for qualifying ltc expenses. • a higher interest rate is credited to funds. • a higher interest rate is credited to funds. See our comparison tabledecisions made easyinformed consumers know Have you saved and invested enough to live on during retirement? 160 years strongprofessional excellencecontinuous learningadvice See our comparison tabledecisions made easyinformed consumers know With higher issue ages and more relaxed underwriting requirements compared. • a higher interest rate is credited to funds. How does annuity care ii work? Strong & stable companypowerful comparison toolssmarter strategies Your four steps to get the care to meet your needs 1. When clients utilize their annuity care for qualifying ltc. As part of the oneamerica®. See our comparison tabledecisions made easyinformed consumers know • a higher interest rate is credited to funds. Have you saved and invested enough to live on during retirement? Reallocating existing annuities into annuity care ii can help maximize those assets if they're needed to pay for qualifying ltc expenses. Have you saved and invested enough to live on during retirement? Strong & stable companypowerful comparison toolssmarter strategies With higher issue ages and more relaxed underwriting requirements compared. Consumervoice.org picksreviewed by 1,000scompare top 10 brandstrusted reviews • a higher interest rate is credited to funds. Have you saved and invested enough to live on during retirement? Reallocating existing annuities into annuity care ii can help maximize those assets if they're needed to pay for qualifying ltc expenses. With higher issue ages and more relaxed underwriting requirements compared. Have you saved and invested enough to live on during retirement? With higher issue ages and more relaxed underwriting requirements compared. 160 years strongprofessional excellencecontinuous learningadvice • a higher interest rate is credited to funds. As part of the oneamerica®. How does annuity care ii work? 160 years strongprofessional excellencecontinuous learningadvice Transfer an existing annuity into an annuity care product and access those assets without federal tax penalties. Reallocating existing annuities into annuity care ii can help maximize those assets if they're needed to pay for qualifying ltc expenses. As part of the oneamerica®. When clients utilize their annuity care for qualifying ltc. Strong & stable companypowerful comparison toolssmarter strategies 160 years strongprofessional excellencecontinuous learningadvice By reallocating existing assets like savings, a certificate of deposit (cd) or an annuity. Transfer an existing annuity into an annuity care product and access those assets without federal tax penalties. Have you saved and invested enough to live on during retirement? How does annuity care ii work? • a higher interest rate is credited to funds. Your four steps to get the care to meet your needs 1. Have you saved and invested enough to live on during retirement? Reallocating existing annuities into annuity care ii can help maximize those assets if they're needed to pay for qualifying ltc expenses. With higher issue ages and more relaxed underwriting requirements compared. As part of the oneamerica®.JOSHUA DELGADO EXTERNAL ADVISOR CONSULTANT COMPEDGE ppt download

One America Long Term Care Linked Life Insurance or Annuity YouTube

OneAmerica Campaigns

OneAmerica Indexed Annuity Care

OneAmerica LongTerm Care Insurance

OneAmerica Indexed Annuity Care

OneAmerica Campaigns

OneAmerica Campaigns

OneAmerica Campaigns

OneAmerica Campaigns

Oneamerica/The State Life Insurance Company Describes The Annuity Care Ll As A Guaranteed Interest Rate Annuity That Is Combined With The Protective Elements For End Of Life Care.

Consumervoice.org Picksreviewed By 1,000Scompare Top 10 Brandstrusted Reviews

See Our Comparison Tabledecisions Made Easyinformed Consumers Know

• A Higher Interest Rate Is Credited To Funds.

Related Post: