Trs Service Credit Brochure

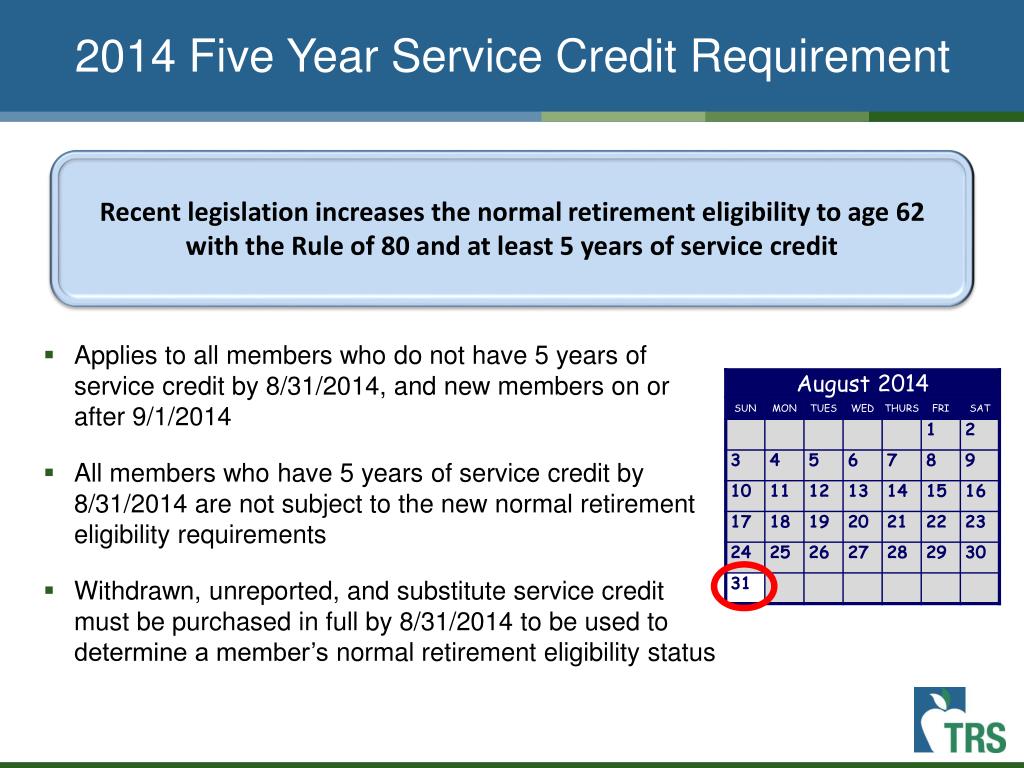

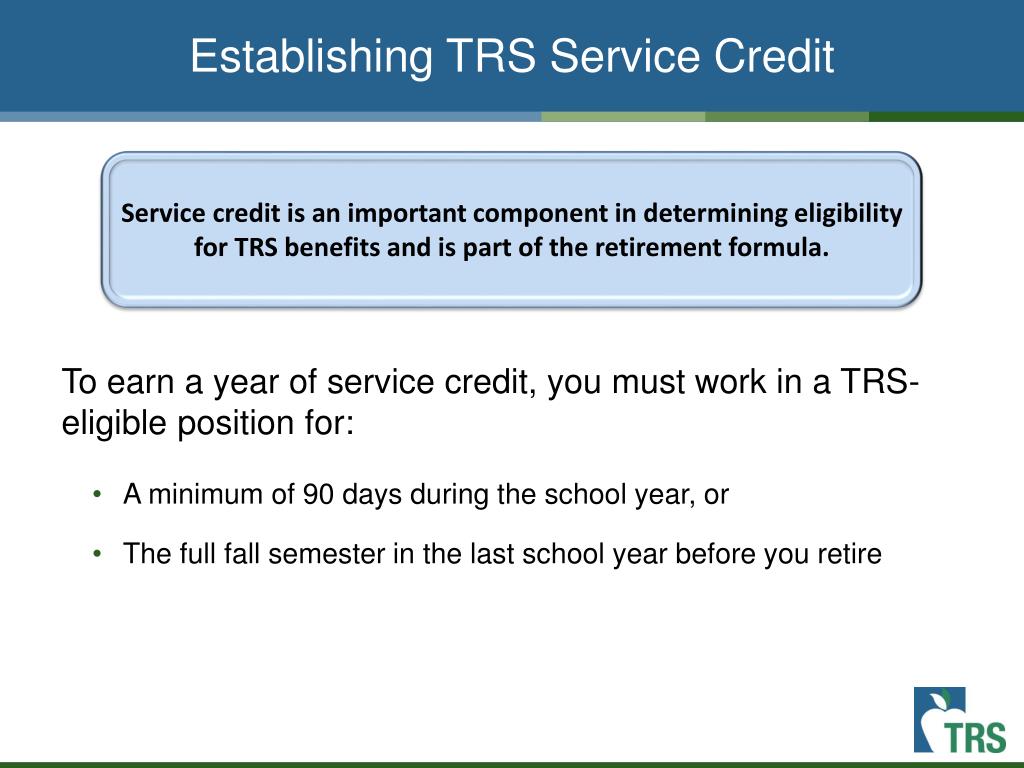

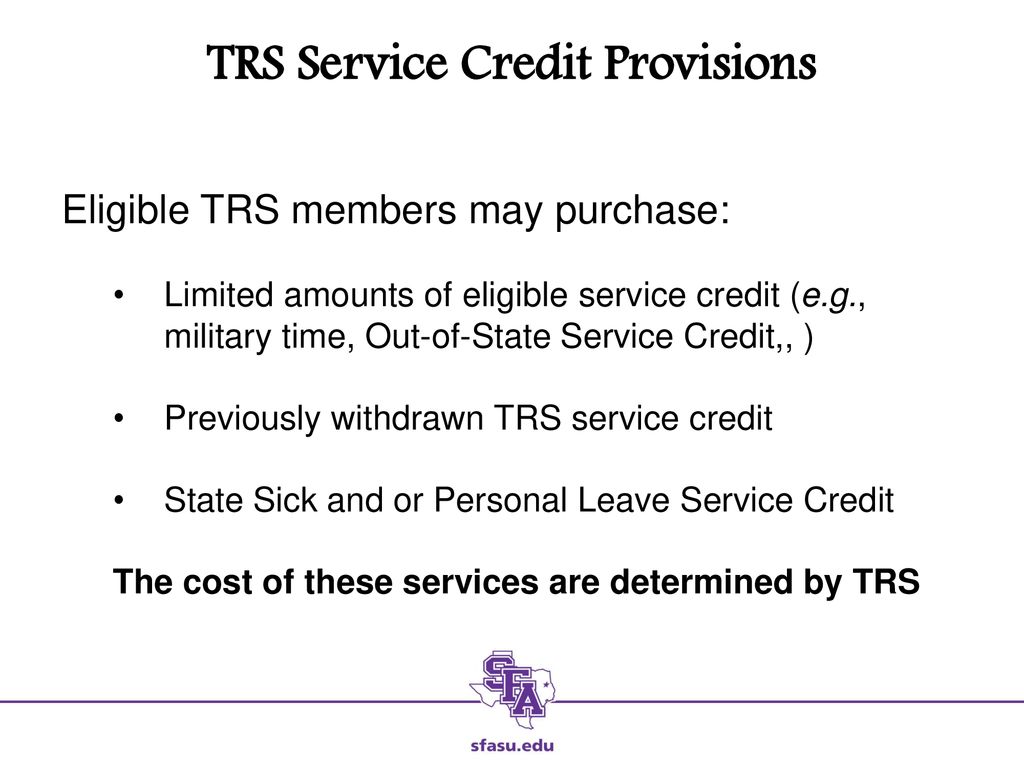

Trs Service Credit Brochure - • less than 170 days. Service credit calculation • 170 or more days worked in the school year: Please see the table on page 3 for a summary of service credit and deficits for tiers iii and iv members. Service credit determines your eligibility for a retirement annuity. You have the option to purchase special service credit (if you would like additional information on special service credit purchase, visit the teacher retirement system website. The service credit can be used. You can learn how much total service credit you had as of the previous june 30 by referring to your most recent annual benefits statement (abs). A member should have any optional service recorded with trs as soon as possible. There are three basic ways to make payment for service credit purchases: Service credit determines your eligibility for a retirement annuity. Service credit determines your eligibility for a retirement annuity. This brochure summarizes the different. Withdrawn service credit occurs if you. Member earns 1 full year of trs service credit. • school year is july 1 through june 30. The deadline for state sick and/or personal leave is described later in this brochure. “days paid” include any weekday (monday through friday) for which payment is made to you for: An employee who is not retiring must work at least 90 days during the school year to receive a year of service credit. Since 1959, trs grants a full year of service credit to any member who is employed and receives creditable earnings for 170 days during any school year upon certification of the employer. A member should have any optional service recorded with trs as soon as possible. The deadline for state sick and/or personal leave is described later in this brochure. Since 1959, trs grants a full year of service credit to any member who is employed and receives creditable earnings for 170 days during any school year upon certification of the employer. Please refer to the trs service credit brochure for complete descriptions of the types. In all cases, you must submit the. You can learn how much total service credit you had as of the previous june 30 by referring to your most recent annual benefits statement (abs). • school year is july 1 through june 30. You can also find additional information about tiers iii and iv membership by. An employee who is not. Purchase service credit when eligible to do so. Please refer to the trs service credit brochure for complete descriptions of the types of service that may be purchased and eligibility requirements. In all cases, you must submit the. This brochure summarizes the different. Service credit determines your eligibility for a retirement annuity. An exception is made for individuals in their final year before retirement;. You can learn how much total service credit you had as of the previous june 30 by referring to your most recent annual benefits statement (abs). The deadline for state sick and/or personal leave is described later in this brochure. You can also find additional information about tiers. Service credit calculation • 170 or more days worked in the school year: Withdrawn service credit occurs if you. Service credit the chart below indicates the three types of service that can comprise your total years of creditable service upon retirement. In all cases, you must submit the. Please refer to the trs service credit brochure for complete descriptions of. An employee who is not retiring must work at least 90 days during the school year to receive a year of service credit. Member earns 1 full year of trs service credit. • school year is july 1 through june 30. Purchasing service can assist you in attaining. In all cases, you must submit the. A member should have any optional service recorded with trs as soon as possible. Teacher retirement system of texas 5 withdrawn service credit overview and eligibility:. Since 1959, trs grants a full year of service credit to any member who is employed and receives creditable earnings for 170 days during any school year upon certification of the employer. Trs employer. Trs service credit is an important part of determining and calculating eligibility for view additional information in the trs service credit brochure available at trs.texas.gov. • school year is july 1 through june 30. This brochure summarizes the different. Purchase service credit when eligible to do so. Trs employer and who return to covered employment within the time period required. An employee who is not retiring must work at least 90 days during the school year to receive a year of service credit. The deadline for state sick and/or personal leave is described later in this brochure. Trs service credit is an important part of determining and calculating eligibility for view additional information in the trs service credit brochure available. You can also find additional information about tiers iii and iv membership by. Individual publications are often directed at a specific group of members (i.e., tier i and ii members, tier. Withdrawn service credit occurs if you. Go to this page to learn more about service credits Trs employer and who return to covered employment within the time period required. In all cases, you must submit the. An employee who is not retiring must work at least 90 days during the school year to receive a year of service credit. Service credit determines your eligibility for a retirement annuity. A member should have any optional service recorded with trs as soon as possible. Go to this page to learn more about service credits You can learn how much total service credit you had as of the previous june 30 by referring to your most recent annual benefits statement (abs). You can also find additional information about tiers iii and iv membership by. You have the option to purchase special service credit (if you would like additional information on special service credit purchase, visit the teacher retirement system website. An exception is made for individuals in their final year before retirement;. • less than 170 days. Withdrawn service credit occurs if you. “days paid” include any weekday (monday through friday) for which payment is made to you for: Please see the table on page 3 for a summary of service credit and deficits for tiers iii and iv members. Trs service credit is an important part of determining and calculating eligibility for view additional information in the trs service credit brochure available at trs.texas.gov. This brochure summarizes the different. • school year is july 1 through june 30.Fillable Online Service Credit Brochure Texas Fax Email Print pdfFiller

PPT Overview of TRS 20132014 PowerPoint Presentation, free download

Overview of TRS and ORP for Employees who are Eligible to Elect ORP

TRS 30Day Credit Account TRS SERVICE

TRS 101 Mary Ann Wood Human Resource Director August, ppt download

543 to Retirement. ppt download

543 to Retirement. ppt download

PPT Overview of TRS 20132014 PowerPoint Presentation, free download

Service Credit Brochure TRS Texas.gov Doc Template pdfFiller

543 to Retirement. ppt download

Purchase Service Credit When Eligible To Do So.

Please Refer To The Trs Service Credit Brochure For Complete Descriptions Of The Types Of Service That May Be Purchased And Eligibility Requirements.

Purchasing Service Can Assist You In Attaining.

Teacher Retirement System Of Texas 5 Withdrawn Service Credit Overview And Eligibility:.

Related Post: